The State of the Global Coatings Industry

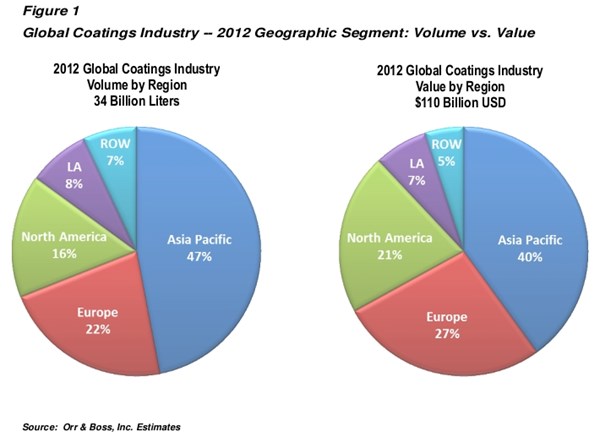

Orr & Boss estimates that in 2012 the global coatings industry was U.S. $110 billion on approximately 34 billion liters.

While not a universally held view, many economists and other pundits expected that 2013 would be the year that the global economy finally fully rebounded from the recession and began to show signs of universal growth.

But at least for the near term, a significant acceleration in growth is not expected. In fact, the International Monetary Fund has lowered its outlook for the world economy this year, cutting its forecast for global Gross Domestic Product growth to 2.9 percent in 2013 and 3.6 percent in 2014. This is a reduction in forecast growth of 0.3 and 0.2 points, respectively, on its mid-year predictions, which had also been revised downward. These lowered economic growth forecasts have significant implications on the global coatings industry.

In late 2012, the International Paint and Printing Ink Council (IPPIC) published the third edition of its respected Global Paint and Coatings Industry Market Analysis report. As with previous versions, IPPIC retained Orr & Boss to prepare this comprehensive market analysis. The coatings market data presented in this article follows the basic market segmentation structure used in these industry reports.

Orr & Boss estimates that in 2012 the global coatings industry was U.S. $110 billion on approximately 34 billion liters. In 2012, the Asia Pacific region represented approximately 40 percent of the value and 47 percent of the volume. Europe comprises 27 percent of the value and 22 percent of the volume. North America, in contrast, makes up approximately 21 percent of the value ($23 billion) and 16 percent of the market volume (about 5.4 billion liters). The remainder is split between Latin America and the Rest of the World (ROW)—primarily the Middle East and Africa.

Decorative coatings make up the largest of the major coatings segments, representing approximately 56 percent of the global volume and 44 percent of the global coatings value. While the percentage of the market represented by decorative coatings does vary somewhat by region, in all cases, decorative coatings volume and value far outweigh any single industrial coatings segment.

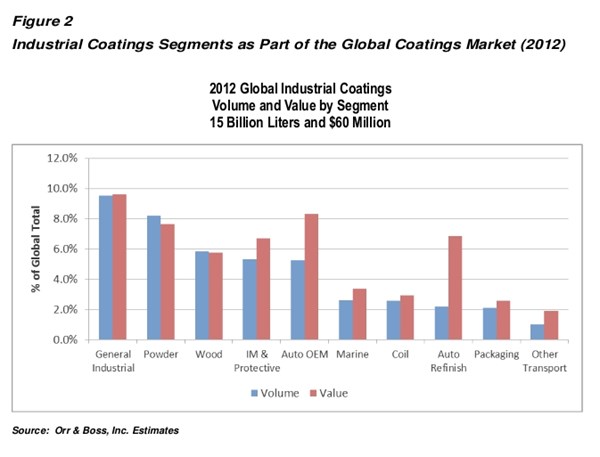

The industrial coatings market is comprised of ten sub-segments. General Industrial is the largest of these sub-segments, comprising roughly 10 percent of the market volume and value. powder, wood, transportation, and IM and Protective coatings are the other large industrial sub-segments. The wide difference in volume and value percentage for segments such as auto OEM, auto refinish and IM and protective indicates that the average prices for these segments are among the highest in the industry. Figure 2 details the market distribution of the Industrial sub-segments by volume and value.

Economic Influences within the Coatings Industry

Coatings demand is influenced by a wide array of economic factors. For example, demand for decorative coatings is affected by housing activity, new construction, and overall affluence. While housing and construction markets in North America and Europe have remained soft over the years following the global financial crisis, activity has continued to be strong in China and other parts of developing Asia Pacific.

As a case in point, while home sales in the U.S. continue to improve, activity is well below peak sales of several years ago. In contrast, over this same time frame, construction spending in China increased by more than 10 percent annually. Housing and construction activity in North America and Europe are forecast to increase somewhat over the next five years, narrowing the gap between these regions and Asia-Pacific. However, the general trend in construction disparity between the East and West is projected to continue.

While growth forecasts for Latin America, Africa and the Middle East are not as strong as those projected for Asia, these regions are also projected to show strong construction growth. As such, growth in the decorative coatings markets in these higher growth regions will exceed growth in North America and Europe.

For most industrial coatings, demand is a function of the production of end use OEM products such as cars, tractors, furniture, packaging, etc. The higher the end use production, the higher the coatings demand. In this regard, North America and Europe are also projected to lag other regions.

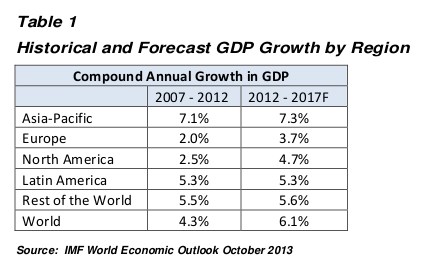

In general, growth in industrial production tends to follow GDP growth. Despite downgrading its forecasts for 2013 and 2014, in its most recent World Economic Outlook, the International Monetary Fund projects that the GDP in all regions of the world will grow at a faster rate over the next five years than the previous five, but that North America and Europe will grow at the slowest rates. Table 1 shows the historical and forecast compound annual growth rate (CAGR) in GDP by region.

$140 Billion on 40 Billion Liters

Based on the construction, GDP and end-use sector builds forecasts, Orr & Boss forecasts that the global coatings industry could reach more than $140 billion on more than 40 billion liters by 2017. The Asia-Pacific market is projected to grow above the global average, albeit at a slightly lower growth rate than seen over the past three years. Of particular note is that the difference between Asia-Pacific and North American growth rates is projected to be reduced significantly. However, by 2017, Asia Pacific will likely represent 50 percent of the global volume. The European and North American regions are projected to represent 20 percent and 15 percent of global volume respectively.

There are divergent trends that could affect this forecast, most notably the growing U.S. energy sector and the trend for some manufacturing to return to the U.S. due to cost inflation in China. In terms of energy costs, the U.S. Energy Information Agency is forecasting that fuel and energy costs in the U.S. will be essentially flat over the next five years. This bodes well for manufacturers and coatings formulators in the U.S. Further exploitation of domestic fuel sources could drive down energy costs even more, accelerating U.S. growth beyond current projections. Conversely, a shift to higher energy prices will slow down the U.S. economy and drive more production to Asia. Time will tell if these trends will continue to slow or even reverse the migration of coatings demand to Asia-Pacific that has occurred over the past ten years.

Charles Bangert, MBA and Scott Detiveaux, MBA are partners within Orr & Boss, Inc., a leading international management consulting firm to the specialty chemicals industry, headquartered in Detroit. www.orrandboss.com Orr & Boss would like to thank IPPIC for allowing them to share in this article some of the data presented in its latest edition of the global coatings market analysis report.

Read Next

A ‘Clean’ Agenda Offers Unique Presentations in Chicago

The 2024 Parts Cleaning Conference, co-located with the International Manufacturing Technology Show, includes presentations by several speakers who are new to the conference and topics that have not been covered in past editions of this event.

Read MoreEducation Bringing Cleaning to Machining

Debuting new speakers and cleaning technology content during this half-day workshop co-located with IMTS 2024.

Read MoreDelivering Increased Benefits to Greenhouse Films

Baystar's Borstar technology is helping customers deliver better, more reliable production methods to greenhouse agriculture.

Read More

.jpg;maxWidth=300;quality=90)