Examining Metallic Fastener Finishes: Performance Factors and Future Trends

A paper* based on a presentation given at NASF SUR/FIN 2023 (Cleveland, Ohio)

by Mark Schario**

Columbia Chemical Corporation

Brunswick, Ohio, USA

Editor’s Note: The following is a paper based on a presentation given at NASF SUR/FIN 2023, in Cleveland, Ohio on June 7, 2023, in Session 7, Automotive. A pdf of this article can be accessed and printed HERE; the complete Powerpoint presentation is available by clicking HERE.

ABSTRACT

1.0 Introduction

With the acceleration of the automotive industry’s move toward electric vehicles, manufacturers and suppliers need to adapt to new substrates and finishes to meet evolving OEM needs. At the same time, when choosing coatings for fasteners, OEM materials and coatings engineers must take into consideration a variety of performance factors when identifying a coating to specify. This paper covers various finishes, new trends and emerging technologies available to meet OEM and fastener supplier needs, as well as those finishes growing in demand for the electric vehicle market.

2.0 Coating options, choice and performance

There are many questions involved in choosing the right finish for a given fastener application. Among them are:

- Corrosion – What environment will the fastener see and what is the expected service life?

- Safety – What is the hardness and material condition of the fastener?

- Durability – Will the fastener be subject to abrasion?

- Temperature – What temperature will the fastener be exposed to?

- Electronics – Will the fastener be used in electronic applications?

- Appearance – Color and gloss needed?

- Size of fastener – What is the size and thread?

- Torque/Tension – What limits are needed for application?

- Cost – What finish is needed to meet the above questions with the lowest cost?

2.1 Metallic layer

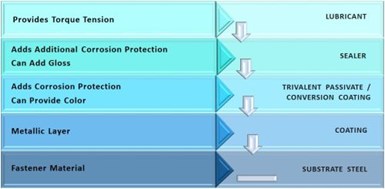

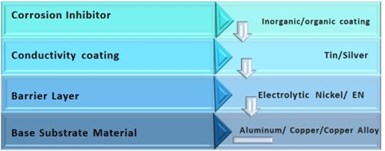

Figure 1 – Basic coating components for a fastener finish.

Figure 1 shows the basic coating components for a fastener. Considering them from the substrate up, we first have the basic metallic coating layer. Those most commonly used are zinc, mechanical zinc, zinc-nickel, zinc flake, tin-zinc and zinc-iron.

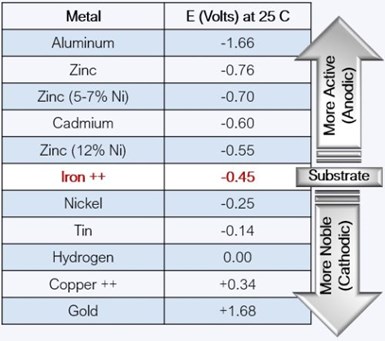

Figure 2 – Determining corrosion potential based on the galvanic series in seawater.

An important function of the metallic coating is its relation to the substrate in terms of its potential in Volts in Galvanic Series Seawater. As shown in Fig. 2, all the coatings above iron are sacrificial or anodic to the substrate. All the coatings below iron are more noble or cathodic to the substrate. Directly above iron is 12% zinc-nickel, so the difference in volts in a seawater environment is 0.1V. Moving up to zinc in the chart, the difference is 0.31V. It is this difference that determines the corrosion potential. The farther apart the metals are on the chart, the more dissimilar they are, resulting in a higher potential for corrosion. Comparing the galvanic couples of typical fastener finishes shows cadmium versus steel at 0.15V, zinc over steel at 0.31V and, depending on the composition, zinc-nickel over steel in the range of 0.5-0.15V.

Taken together, Fig. 3 compares the important properties of the six finishes considered here.

Figure 3 – Performance comparison of the most commonly used metallic coating finishes for fasteners.

2.2 Trivalent passivate / conversion coating

The trivalent passivate / conversion coating provides protection from white corrosion products and extends the hours to red basis metal corrosion. In general, one nanometer of thickness provides one hour of protection to first white rust (FWR). In addition, the passivate provides color to the finish, depending on the thickness:

- Clear to blue = 0 – 130 nanometers

- Iridescent = 170 – 350 nanometers

- Black = 50 – 250 nanometers

The texture is generally flat, unless a sealer is used.

2.3 Sealer

The sealer provides additional salt spray performance by providing an additional layer of protection. It can be organic, inorganic or a combination of both. It provides gloss where needed and can provide some lubricity to the fastener.

2.4 Lubricant / torque tension

The lubricant layer provides lubricity and control of critical joint applications. It can contain an integrated UV additive for application verification. It can be a lubricant or a combination of a lubricant and a sealer.

3.0 Benefits of zinc-nickel

Zinc-nickel deposits have two to three times the hardness of zinc plating, which is great for scratch resistance. When combined with resistance to heat, and increased corrosion protection, zinc-nickel is well suited to meet the increasingly demanding specifications and desire for longer-lived components to reduce warranty claims. The zinc-nickel market is further influenced by the continued growth of the electric vehicle market due to its durability and corrosion resistance.

Zinc-nickel was introduced as a replacement for cadmium several years ago in the aerospace industry and continues to grow in usage and popularity in that industry based on its properties. In the agriculture industry, zinc-nickel was looked at in combination with high performance sealers to resist the harsh chemicals in fertilizers. And of course, in the automotive industry we know that it has risen in popularity in its use for safety-critical components as well as high temperature, under-the-hood applications. Beyond zinc-nickel, it should be noted that tin-zinc is also needed for electrical components, but at reduced volume.

Overall, the zinc-nickel market continues to increase. Driven in part by the need for increased vehicle life (automotive warranties) and a subsequent demand for enhanced corrosion protection, the zinc-nickel market has outpaced demand for zinc. From 2013 through the end of 2016, the zinc-nickel market grew 40% versus the zinc market, which grew only 2.5% over the same time period.

Within the same time frame, the acid zinc-nickel market has increased versus alkaline zinc-nickel. Alkaline zinc-nickel originally held 93% of the zinc-nickel market in 2013 with acid zinc-nickel holding at 7%. However, acid zinc-nickel has gained in popularity. By 2016, it had grown to 13% of the market with alkaline zinc-nickel coming in at 87%. The percentage of the market held by acid zinc-nickel nearly doubled in this four-year time frame as newer technologies became available and the benefits of acid zinc-nickel over alkaline in specific applications were recognized (to be covered later).

As for corrosion performance, compared with zinc alone, zinc-nickel has a phase or metallic structure difference that forms stable white corrosion products, enhancing corrosion protection. When looking at the difference in corrosion rate in microns/year, zinc-nickel (1-2 μm/yr) can yield up to 25 times the corrosion protection of pure zinc (50 μm/yr) depending on the atmospheric conditions.

Given what is discussed here and where the industry is headed, demand for zinc-nickel and zinc-nickel alloy finishes will continue to increase in the future. Zinc-nickel is becoming more popular due to performance and a better supply base. Analysis of trends indicates that there is new interest in alloy coatings for use in electric vehicles. There is renewed interest in tin-zinc for automotive applications with fasteners near electronic components.

3.0 Role of zinc-nickel and tin-zinc in the electric vehicle market

As recently as five years ago, there continued to be doubt about the viability and growth of the electric vehicle market but now, that is all changing. The road map to electric vehicles is firmly in place. This disruptive technology change will happen faster than we might think.

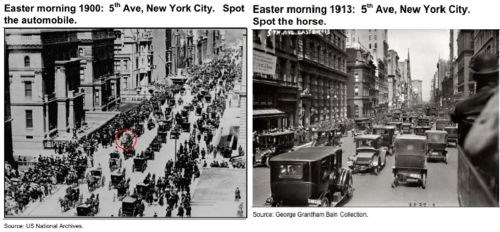

One of the most relevant examples of this type of disruptive technology happened in the early 1900s (Fig. 4). On a bright Easter morning in 1900, you could only spot one lone automobile amongst 50 horse-drawn vehicles on busy New York Street. Just thirteen short years later, on the same street, in the same town, there was only one single horse-drawn vehicle to be found amongst all the automobiles. Disruptive change had happened. And it's upon us now with electric vehicles.

Figure 4 – A century-old example of disruptive technology.

3.1 EV market outlook

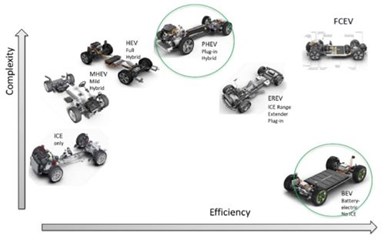

When we talk about electric vehicles, it is important to note that there are many different types of electric vehicles. These types of electric vehicles, as well as different technologies, are all in the running and are evolving. In fact, some technologies may eventually supplant the technologies in vogue today.

Figure 5 – Complexity and efficiency of various EV technologies.

Nonetheless, as of today, Fig. 5 shows several of the EV technologies, and their acronyms, vying for attention.

Of course, ICE stands for internal combustion engine, for the traditional automobiles most common today. From there, we have the MHEV or mild hybrid electric vehicle (MHEV), the full hybrid version (HEV), the plug-in hybrid electric vehicle (PHEV), the EREV, which is an electric vehicle with a small ICE, and the Battery electric vehicle (BEV) with no ICE involved. In the upper right of the figure, we also have Fuel Cell Electric Vehicles (FCEV), or hydrogen powered vehicles, waiting in the wings and the subject of considerable research.

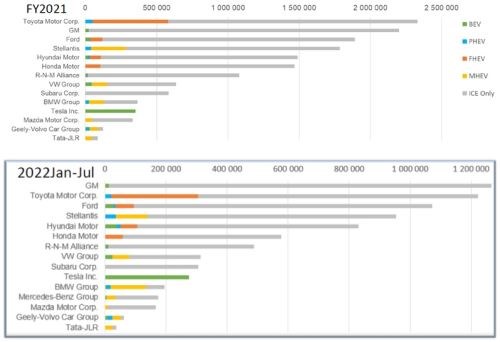

Figure 6 shows the growth of electric vehicle volumes with USA OEMs in the full fiscal year of 2021 and then the first six months of 2022. Note that for full battery electric vehicles, Tesla is projected to sell approximately double the number of cars in 2022 versus 2021. For the mild hybrid cars (ICE with battery), there is an upward trend of these vehicles as consumers begin to make the transition.

Figure 6 – EV volumes for US OEMs: FY2021 and 2022 (first half).

Between 2021 and 2028, the OEMs are planning the launching of 87 battery electric vehicle (BEV) models in their high profit margin segments (SUVs, CUVs and PUPs). Figure 7 shows some examples of the electric vehicles being launched in coming years.

Figure 7 - Examples of the electric vehicles planned for launch in 2021-2028.

These models are on multiple platforms of cars, trucks, SUVs and even commercial light duty trucks. It is important to note that, with the rapidly evolving market, these vehicle launches change frequently. It does, however, show that the new EV launches are significant and growing.

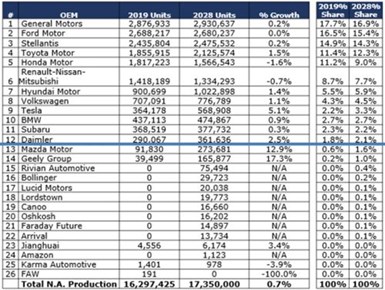

In the chart in Fig. 8, the OEM market shares from 2019 and expected growth to 2028. Obviously, there are many new players entering the North American market. Some will make it, some will not, but we can see that the landscape is definitely changing from the way we knew it 10 years ago.

Figure 8 - OEM electric vehicle market shares from 2019 and expected growth to 2028.

The three Detroit OEMs (Ford, GM and Stellantis) comprise 46.6% of 2028 North American (NA) production volumes. The three major Japanese OEMS (Toyota, Honda, and Nissan) account for 29% of the 2028 NA volumes. The German OEMs (BMW, Daimler and VW) account for 9.3% of 2028 NA volumes. Other Asian-based OEMs (Hyundai, Subaru, Mazda, Geely, Jianghuai and FAW) will account for 10.6% of the 2028 production volumes in North America, while Tesla accounts for 3.3%. The new EV start-ups known today will account for 1.2% of the NA volume. These include Rivian, Bollinger, Lucid, Lordstown, Canoo, Oshkosh, Faraday Future, Arrival, Amazon/Zoox and Karma.

3.1 Effect of EVs on metal finishing outlook

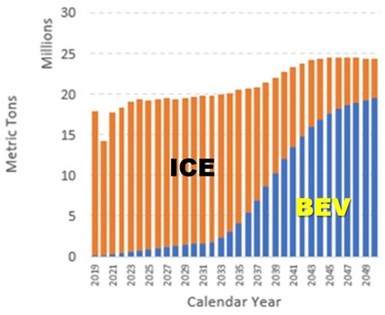

Figure 9 - Projected steel usage for battery electric and internal combustion vehicles.

Figure 9 shows the projected steel usage for electric vehicles. The blue area in the bar chart shows the steel usage outlook for the battery electric vehicles. Market demand for battery electric vehicles (BEVs) will increase as battery costs continue to decline. In addition, “carbon neutral materials” will be required to reduce total greenhouse gas emitted over the vehicle's usable life. The orange bars represent steel usage for internal combustion engine vehicles, which shrinks considerably over time. Nonetheless, as shown, super-imposing the ICE profile onto the BEV profile shows a slight increase in steel requirements.

An area of interest to many suppliers and finishers is what the powertrain shift between ICE and BEV will mean. Figure 10 offers an overview of some of the components in the ICE and what the market shift to BEV will look like. For example, the combustion engine will be replaced with a battery and charging devices. As a result, the powertrain components will change but there will still need to be fasteners and brackets holding all these powertrain components together.

Figure 10 – Market shifts in the components used in ICE versus EVs.

The question of the fastener needs in a power system involving batteries and electrical systems basically involves the fact that the fastener may be involved in current flow. The needs may involve a mix of metallic and non-metallic substrates. They may be involved in weight reduction assemblies. Most importantly, they must maintain contact resistance and conductivity over the life of the vehicle. At present, the frontline coatings of choice that meet these needs are zinc-nickel and tin-zinc.

Referring to the data in Fig. 3, Fig. 11 reviews the coating properties and attributes of zinc-nickel and tin-zinc versus pure zinc. It is important to note that the salt spray hours can differ drastically, depending on the passivate and sealers, but in general, better corrosion resistance is realized with the alloy coatings. There is less risk of hydrogen embrittlement, but unfortunately, you have a higher cost for the alloy deposits.

Figure 11 – Performance and attributes of zinc-nickel and tin-zinc for EV applications.

Buss bars and connectors are also major components in EV vehicle systems. Here, instead of steel, the substrate may consist of aluminum, copper or a copper alloy. Figure 12 shows the elements of a coating system for such applications, and the coatings associated with them. For these components, the coatings need high conductivity and contact resistance should remain as constant as possible over the life of the vehicle.

There are a number of different coating technologies but mentioned here are a few combinations.

Figure 12 – Basic coating components for a buss bar or connector finish.

A barrier layer-electrolytic nickel or possibly electroless nickel, on top of that a tin or silver layer, then finally some sort of corrosion inhibitor may be applied to keep the surface performance uniform over many years of service. The objective here is a coating system that has good contact resistance and is stable over the vehicle life. This is new territory for the industry and is evolving as rapidly as vehicle technology.

With the switch to battery electric vehicles, there will also be some raw material challenges not just in mining but in processing the different metals used. Cobalt is a critical component in batteries and may come in short supply if mining and processing do not keep up with the pace of growth. Cobalt is an anti-corrosion metal used in small amounts in modern-day zinc passivates. Subsequently, there may be a need for cobalt-free passivates in the future from a supply/price issue. There will also be a need for coatings and passivates for aluminum substrates and new coatings that can perform with multi-metallic substrate combinations. Finally, it cannot be forgotten that related sustainability issues will require advances in battery reclamation technology.

In summary then, the coatings that will be needed for battery vehicles are:

- Zinc

- Zinc-nickel

- Tin-zinc

- Tin

- Silver

- Electroless nickel

- Copper

4.0 Passivate Finish Options & Torque Tension Modifiers

4.1 Trivalent passivates

After years of research to replace carcinogenic hexavalent chromium passivates, trivalent chemistries are a reality. Both thick and thin film chemistries are available, and the finish options are numerous, including clear, blue, black, yellow and iridescent coatings, among others.

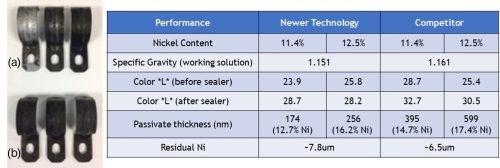

Black passivates are of particular interest to the OEMs. The specifics of what they are looking for are (1) a deep black color, (2) the least amount of coating loss in reacting with the zinc-nickel metallic overlayer and (3) enhanced corrosion resistance.

To address these needs, we have developed a proprietary cobalt-free black passivate. Figure 13 shows some performance data comparing our black passivate (b) versus a competitor’s that we felt had the best black passivate (a). The important data here is the color “L” number before sealer, and of course the residual nickel remaining after the passivating process. It will be noted that the newer technology black passivates have a darker deeper black and remove less zinc-nickel layer in the process.

Figure 13 – Performance comparison of black passivates: (a) competitor technology, (b) newer proprietary cobalt-free technology.

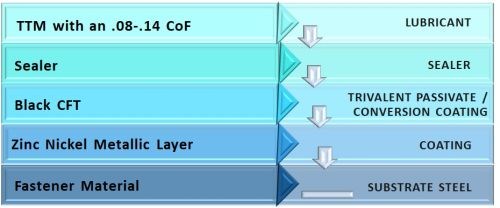

4.2 Torque tension modifiers

There are new options available in the market that take advantage of newer cobalt-free technology, combined with high gloss sealers and torque tension modifiers to deliver the consistency and corrosion protection that OEMs need. Torque tension friction coefficients are in the 0.08-0.14 range. The complete system is shown schematically in Fig. 14, with (1) a zinc-nickel metallic layer, (2) a black cobalt-free trivalent passivate, (3) a high gloss sealer and (4) a torque tension modifier lubricant.

Figure 14 – Schematic diagram of advanced fastener coating system for OEM needs.

5.0 Summary

The automotive industry is moving rapidly toward electrification and new substrates and finishes are needed to meet the demand.

There are a variety of important factors to be considered when choosing a coating to specify.

Zinc-nickel continues to grow in popularity across the automotive, agriculture and aerospace industries. Tin-zinc is growing in demand for the EV market.

The electric vehicle market will drive innovation of new coatings systems and will provide the opportunity for platers to branch out with new metallic and organic coatings to grow with the market.

6.0 About the author

Mark Schario, CEF, CFS, serves as Chief Technology Officer for Columbia Chemical. He has more than 30 years of experience in the surface finishing industry and is world renowned for his expertise on the subject of Decorative Trivalent Chromium Plating. Mark functions as the company’s top liaison to the automotive industry, consulting with OEMs and Tier 1 suppliers worldwide. He serves on an AIAG workgroup and is Chairman to the ASTM B08.10 Technical Subcommittee on Metallic and Inorganic Coatings, which has jurisdiction over 132 standards. He is a member of the National Association for Surface Finishing and has earned the industry designation of CEF/Certified Electroplater-Finisher and CFS/Certified Fastener Specialist. Mark holds an Executive MBA from Case Western Reserve University.

** Corresponding author:

|

Mark Schario |

Related Content

NASF/AESF Foundation Research Project #123: Electrochemical Manufacturing for Energy Applications - 6th Quarter Report

The NASF-AESF Foundation Research Board selected a project on electrodeposition toward developing low-cost and scalable manufacturing processes for hydrogen fuel cells and electrolysis cells for clean transportation and distributed power applications. In this period, work focused on 3D printing anode support for solid oxide fuel cells, SOFC (or cathode for solid oxide electrolyzers, SOEC) based on our designed optimization outlined in the previous report.

Read MoreSUR/FIN 2023 Registration Is Now Open

The National Association for Surface Finishing SUR/FIN 2023 surface finishing industry trade show will take place June 6-8, 2023 in Cleveland, Ohio.

Read MoreDevelopment of a Novel Hexavalent-Chromium-Free Aluminum Sacrificial Paint

Hexavalent chromium is a known carcinogen, repro-toxin, and mutagen. Its elimination is of high importance to the aerospace industry, which has struggled to find high performing alternatives. Legacy aluminum sacrificial paints have traditionally utilized hexavalent chromium to prevent corrosion and coatings which are equal to or better than have been difficult. This first paper discusses the novel process from the supplier point-of-view.

Read MoreNASF/AESF Foundation Research Project #123: Electrochemical Manufacturing for Energy Applications – 4th and 5th Quarter Report

The NASF-AESF Foundation Research Board selected a project on electrodeposition toward developing low-cost and scalable manufacturing processes for hydrogen fuel cells and electrolysis cells for clean transportation and distributed power applications. During the reporting period, efforts were focused on planning the overall project work, with the eventual goal of manufacturing an improved design for a Solid oxide fuel cell anode supported flat tube (SOFC).

Read MoreRead Next

Education Bringing Cleaning to Machining

Debuting new speakers and cleaning technology content during this half-day workshop co-located with IMTS 2024.

Read MoreA ‘Clean’ Agenda Offers Unique Presentations in Chicago

The 2024 Parts Cleaning Conference, co-located with the International Manufacturing Technology Show, includes presentations by several speakers who are new to the conference and topics that have not been covered in past editions of this event.

Read MoreEpisode 45: An Interview with Chandler Mancuso, MacDermid Envio Solutions

Chandler Mancuso, technical director with MacDermid Envio discusses updating your wastewater treatment system and implementing materials recycling solutions to increase efficiencies, control costs and reduce environmental impact.

Read More

.jpg;maxWidth=300;quality=90)