Finishers Report Quickening Deceleration in August

As Index declines for third consecutive month, the pace of slowing expansion intensifies

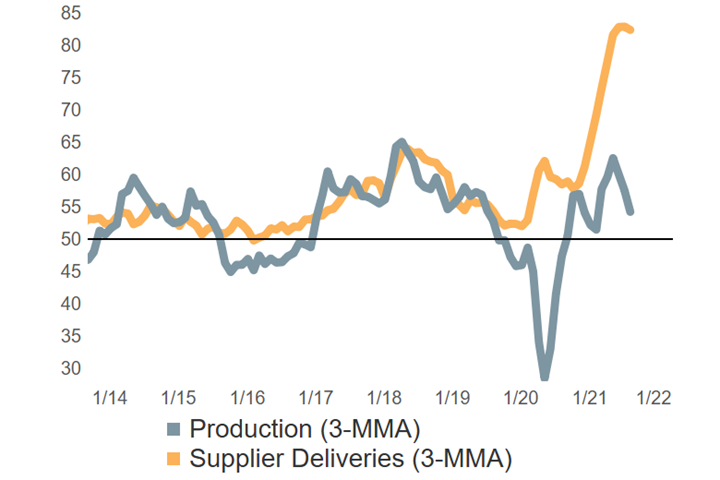

The August reading of the Finishing Index declined by over 3 points to close at 57.5. Declining readings above 50 indicate slowing industry expansion while the magnitude of month-to-month change indicates the pace of that change. August’s decline was produced by significantly lower month-to-month readings for production (-5 points), employment (-6.5-points) and backlogs (-5 points). The reading for supplier deliveries — which proxies for the timeliness of order-to-fulfillments — moved higher, indicating yet another month in which supply chains underserved finishers who have faced shortages of critical materials for most of the calendar year.

August’s production reading not only fell by 5-points, but also fell below a reading of 50 — the value which separates expanding from contracting activity — for the first time in 2021. Historically new orders and production readings have served as leading indicators of overall industry direction; however, recent readings should be interpreted with greater subtlety. Unprecedented supply chain problems coupled with simultaneously high backlog readings could suggest rather that supply chains are strangling production and, by extension, employment activity. If this interpretation is more accurate, then recent low readings are only indicative of the power of disrupted supply chains, not an industry nearing contraction.

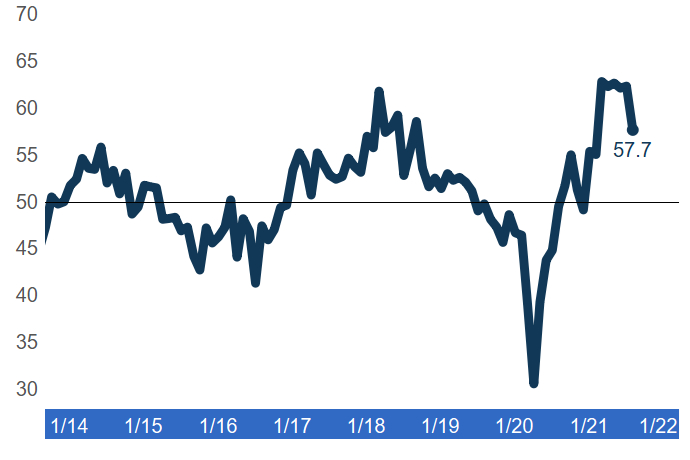

Finishing Index

The Finishing Index finished lower in August. The latest results suggest that severe supply chain problems are having a worsening impact on production and hiring.

Production Contracts for First Time in 2021

Production activity reported contracting activity for the first time in 2021. Production activity readings have moved lower in every month since March 2021 while backlog readings remain strongly elevated.

.jpg;width=70;height=70;mode=crop)