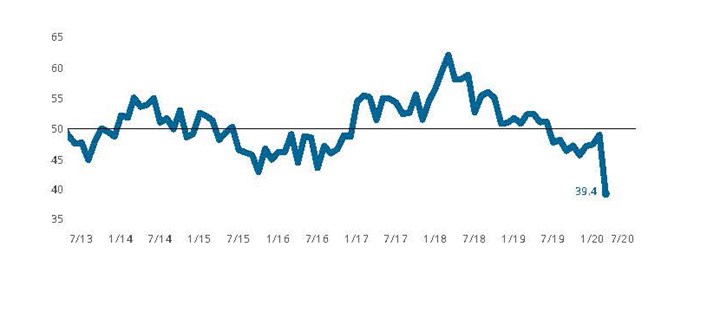

Finishing Index Contracts as COVID-19 Disrupts Economy

Index falls to historic low as domestic and foreign orders activity weakens.

The Finishing Index fell sharply in March to an all-time low of 39.4 as new orders, production, employment and exports all set historic low readings. The first quarter of 2020 was severely disrupted as a growing number of governments across the globe severely curtailed normal economic activity to contain the spread of COVID-19. The result was a significant worldwide reduction in business activity indicators. As such, it is important to remember that the GBI readings represent the breadth of change occurring within the industry and are not to be confused with any rate of decline taking place. These low readings indicate only that a large proportion of finishers reported a decreased level of business activity in March as compared to February without quantifying the actual magnitude of the downward change.

Dissimilar to the other components of the Index, the reading for supplier deliveries moved significantly higher. The reason for this has to do with how the supplier delivery question is asked with the response options being ‘slower,’ ‘same’ and ‘faster.’ In normal times, when demand for upstream goods is high, supply chains cannot keep pace with these orders. The resulting backlog of supplier orders thus lengthens their delivery times. This delay causes surveyed firms to report slowing deliveries and, by the survey’s design, elevates the supplier deliveries reading. The world’s efforts to slow the spread of COVID-19 has significantly disrupted supply chains worldwide. It is because of this disruption, as opposed to strong demand for upstream products overall, that supplier delivery times have lengthened and the reading has increased.

Gardner’s Finishing Index is unique in its ability to measure the status of the industry on a monthly basis. For this reason, it is one of the industry’s best tools for making data-driven decisions at a time when it is otherwise tempting to make impulsive and emotional decisions. Your participation in the survey enables Gardner to accurately report back to you, our readers, the impact of COVID-19 on the industry, including the virus’ eventual passing and resumption of more normal business conditions. With your help, it is our belief that the Finishing Index will provide a first glimpse at that eventual and inevitable rebound.

Finishing Index:

The Index was hard hit in March by the forced closure of much of the world’s economy in order to slow the spread of COVID-19. Activity readings for new orders, exports, production and employment all set record low readings.

Finishers Report Lengthening Supplier Deliveries, While New Orders Fall to All-Time Low

Survey respondents reported a steep contraction among most elements of business activity. The reading for supplier deliveries is designed to increase when supplier deliveries slow under the assumption that suppliers are experiencing higher backlogs and need longer to get parts to manufacturers. In the current situation, it is COVID-19’s massive disruption to the world’s supply chains that is causing longer delivery times.

Related Content

-

Masking Solutions Provider CFS Dramatically Expands Capabilities and Capacity

Custom Fabrication & Supplies (CFS) completed a new plant expansion packing 10 times the capacity into twice the space. It dramatically enhances the supplier’s custom capabilities to provide extremely precise and cost-effective masking solutions.

-

Products Finishing Reveals 2024 Qualifying Top Shops

PF reveals the qualifying shops in its annual Top Shops Benchmarking Survey — a program designed to offer shops insights into their overall performance in the industry.

-

Surface Prep Solution for Rusted Rebar in Concrete

Julie Holmquist of Cortec Corporation discusses passivating corrosion on rebar and other reinforcing metals.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)