Rising from the Ashes

How one finishing job shop expanded its plating business the hard way.

When Paul Springer made the decision to buy out a struggling competitor in early 2005, he had no idea that he would have to basically rebuild the former Atlas Plating plant and its equipment before he could begin production.

“Fifteen months ago, I bought my 30-year competitor right across the street,” recalls Springer, president of Cleveland-based job shop Springco Metal Coating. “The plant caught fire one month after we bought it. The fire started on a Saturday night; fortunately, no one got hurt. It started in the main electrical connection box where the service comes into the building.”

The fire destroyed the building’s roof, sending debris cascading into the process equipment below, a rack zinc electroplating line. The building also housed another plating line that was standing idle, a phosphate line and several smaller processes, such as pickle-and-oil.

At this point, Springer had a decision to make: take the insurance money and run or rebuild the building and plating line. Never one to shrink from a challenge, he chose to rebuild.

“We decided to rebuild the line and the building,” he says. “It was a total rebuild, and it included switching the zinc process from alkaline to acid chloride. We had to line the tanks and make other changes to accommodate that switch.”

The plant’s wastewater treatment system also had to be completely rebuilt. “We’re grandfathered here on this side of the street; the other building was considered a new operation” Springer explains. “And, Cleveland’s pretty tough. They check our effluent pretty regularly. Rebuilding the waste treatment system cost $500,000.

“Lights, wiring, control room, offices and equipment all had to be rebuilt,” he continues. “It took us a year.”

Other capital costs include $200,000 worth of new copper and stainless racks. Total cost of the rebuild was $3 million.

Company History

Why go to all that trouble to get into a business where many shops are struggling to survive in the face of global competition and increasing regulation?

The answer, basically, is that Springer is a stubborn, savvy and driven businessman. His shop was first featured in the pages of Products Finishing more than 26 years ago, in the November 1979 issue. Then-editor Gerard H. Poll, Jr. reported how the young Springer, a freshly minted PhD in chemical engineering, worked briefly for a large coating supplier before launching his own business with a used conveyor system to apply water-borne dip coatings to automotive parts.

“I wasn’t a good fit for the corporate world…I’m just too much a maverick for the large organizational structure,” Springer told Poll.

Those same maverick tendencies are still in evidence, and that original conveyor is still in operation. But the rest of Springer’s business has evolved through several iterations. Currently, the main focus is on electrocoating and powder coating of automotive components.

Springer has gone from tenant to owner of the nine-acre industrial complex that still houses his main operation. Springco also operates four other plants and a warehouse—a total of nine coating lines, 300,000 sq ft of space and about 350 employees.

“Our big lines are e-coat and powder on the same line,” Springer explains. “It makes the lines very long, it makes them very expensive, but it allows us to hang a part one time and dual coat it.” Cycle time on the smaller of two e-coat/powder lines is about 85 minutes; cycles on the larger line are 2 hours, 20 minutes. Two smaller compact e-coat lines have cycle times of 41 minutes and 53 minutes.

Springer believes the combined lines position his company well for a trend toward what he calls dual coatings. “We’re seeing a lot of dual coatings being specified—plating and e-coat, e-coat and powder, plating and powder,” he explains. “It’s where the world’s headed in terms of corrosion protection. So, coatings are getting more and more sophisticated, and they’re lasting longer and longer. And if dual coating is going to be big, we want to be in it.”

An example of a dual-coated part is a component for Daimler Chrysler’s Alabama Mercedes plant that is electroplated then electrocoated, Springer says.

Another operation housed in the original plant building is production of aluminum alternator parts for Ford Motor Company using a powder coating process developed in-house.

“We’ve been running an aluminum diode plate for Ford alternators since 1991,” Springer says. “But it’s not conventional powder coating; it’s a process called blow coating. Instead of using an electrostatic charge to help the powder stick, the process heats the part. We coat the part for electrical insulation, not corrosion protection. We’ve probably done 60 million diodes without a field failure.”

The only non-organic processes still running in Springco’s original plant building are a nitric acid dip used to pretreat the surface of the diode plates before blow coating and a very limited amount of hexavalent chrome plating that’s done for one customer using a relatively small hoist line.

Ahead of the Curve

Springco will deal with the upcoming reduction in the hex chrome personal exposure limit (PEL) for workers by simply exiting the business. The rebuilt zinc line gives the company a leg up in this regard, because it uses all trivalent chromium post-treatments.

“We’re kind of ahead of the curve on the trivalent chromates and we’re seeing quite a few potential customers who want to make the switch from hex,” says Vice President David Starn.

“We do clear, yellow and black trivalent chrome,” Starn reports. “We’re one of the few companies doing black right now, and one of the few operating a large rack system using tri yellow, which is relatively expensive.”

According to Starn, many customers are switching from yellow to clear trivalent chrome to avoid the increased costs of yellow. “You get the same salt spray performance, and there are no problems getting clear,” he explains. “Some customers still want yellow, for example, to differentiate a right and left part. But clear is the majority of the business.”

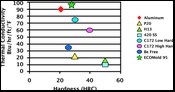

Both clear and black chromates require a topcoat sealer to meet corrosion performance and other specifications. Starn says Springco’s clear parts have passed 600-hr salt-spray exposure tests at an independent test lab.

The automated return line uses acid chloride zinc chemistry to process up to 60 racks per hour. Some racks can hold up to 140 small parts. The rebuilt line’s throughput of 6,000—7,000 small parts per hour is about three times that of the old hoist line located across the street, according to Starn.

All the chemistry for both the zinc electroplate and chromate portions of the line is supplied by Cleveland-based Pavco Inc. and switching between clear, black and yellow chromates takes about 45 minutes, Starn says.

Crawling from the Wreckage

Rebuilding the physical plant and the plating line was only one piece of getting the plating business back up and running, according to Springer. “My competitor had built the business to about $5 million a year,” he says. “When the fire happened, of course, a large chunk of that business disappeared.”

But he believes Springco can be successful in the plating market. “We got the line running again in February, and in March it really started to click,” Springer says. “At that point we started going hard after the business we had lost and also looking for new business.”

Springer is encouraged enough by the initial interest from potential customers that he’s already planning to rebuild and start up a second line of equal capacity that currently sits idle in the same building as the rebuilt line. “We’ll rebuild that one to run alkaline zinc. We used an outside general contractor to help us rebuild that first line. But now that our engineers have seen how to do it, we’ll be the general contractor for the next one.” Springer says the goal is to have both lines running by the end of the year, and expects the cost to rebuild the second line to be about $400,000.

According to Springer, the plating market, and the competition for it, is different than that for the organic part of his business. “In e-coat and powder coat, we’re centered in eight or 10 big accounts,” he says. “Plating is much more fragmented; there are all these small accounts and smaller competitors.”

But entering the Cleveland area plating market fits with his business philosophy. “My thought is, if you’re going to be in a market in metal finishing right now, you’d better be a major player,” Springer says. “Because the market isn’t growing, it’s shrinking. So, you can hang on longer if you’re the biggest.

“I see an opportunity to be a player in this market as well,” he continues. “I think we’re ahead of the curve on the trivalent chromates, and I think some of our smaller competitors are going to have a lot harder time making the switch from hex to tri.”

Read Next

Delivering Increased Benefits to Greenhouse Films

Baystar's Borstar technology is helping customers deliver better, more reliable production methods to greenhouse agriculture.

Read MoreEducation Bringing Cleaning to Machining

Debuting new speakers and cleaning technology content during this half-day workshop co-located with IMTS 2024.

Read MoreEpisode 45: An Interview with Chandler Mancuso, MacDermid Envio Solutions

Chandler Mancuso, technical director with MacDermid Envio discusses updating your wastewater treatment system and implementing materials recycling solutions to increase efficiencies, control costs and reduce environmental impact.

Read More

.jpg;maxWidth=300;quality=90)