Rising Supplier Delivery Reading Sustains Expansionary Index Trend

Industry Signals Slowing Business Expansion Excluding Rocketing Supplier Delivery Activity

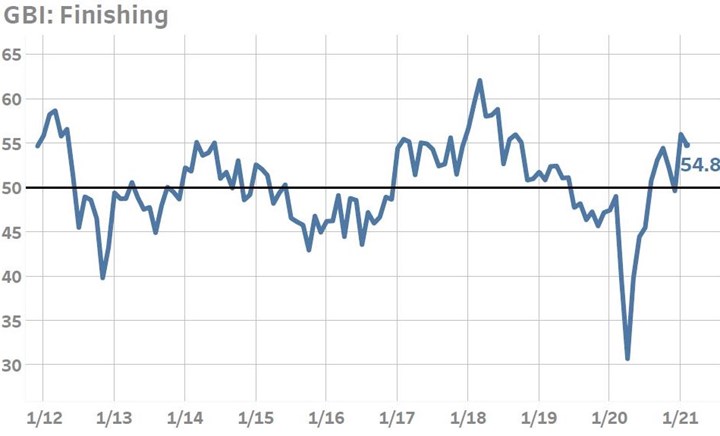

The Gardner Business Index (GBI): Finishing moved only marginally lower in February as five of the Index’s six components reported either slowing growth or, in the case of exports, contracting activity. The index was largely supported by a 2-point gain in the supplier delivery reading. In the six-month period through February, many business activity types including new orders, production and employment have generally reported modestly quickening expansion. Measures of backlog and export orders activity have been more muted over this period while supplier delivery readings have soared into uncharted territory. The reading for supplier deliveries -which moves higher as order-to-fulfillment times lengthen- has set three consecutive all-time high readings as of the February reading.

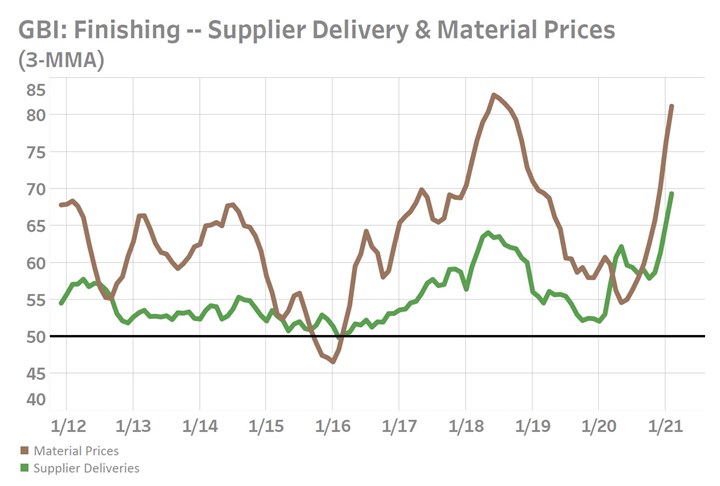

The unprecedented slowing of supply chains in 2020 and now 2021 is having an amplified affect on material prices. The history of the GBI suggests that even modest fluctuations in supplier delivery readings can have amplified affects on material prices. This could mean that material prices will continue to sharply rise while supply chains remain disrupted by COVID.

Finishing Index

Many components of the finishing index reported slowing expansion in February; however, these declines were largely offset by slowing delivery times which elevated the supplier delivery reading.

Supplier Delivery Activity has Amplified Affect on Material Prices

The history of the Finishing Index suggests that even modest changes in supplier delivery activity can have an outsized influence on material prices. This will have significant ramifications for the industry’s 2021 profitability.

The history of the Finishing Index suggests that even modest changes in supplier delivery activity can have an outsized influence on material prices. This will have significant ramifications for the industry’s 2021 profitability.

Finding reliable and relevant data to help guide your business is always important, but especially so during challenging economic times. For this reason, the GBI Finishing Index serves as a great tool for making data-driven decisions. Thank you to everyone who has previously completed our GBI surveys. Your participation helped increased response counts by 15% in 2020, making the GBI better than ever because of your involvement. Thank you for your time and efforts and for trusting us to provide you with the latest industry and business insights both in the past and in the future.

Related Content

-

Columbia Chemical and Alufinish Announce Collaboration

By combining their sales and service capabilities and resources for the U.S. market, the two companies will cover the entire aluminum alloy surface treatment process from pre-treatment to anodizing and coating.

-

Finishing Activity Ended March Down 1 Point vs. February

Finishing Activity: March saw the index revert to flat, closing at 50.3 compared to February’s 51.3.

-

Finishing Activity Ended February Up 1.7 Points vs. January

The improved start to 2023 carried into February which closed at 51.3 compared to January’s index of 49.6.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)