You can say Michael Coburn has an affinity for the finishing industry, although it started fairly recently and has grown at warp speed.

In 2015, Coburn led an investment group in purchasing a Los Angeles plating operation, All Metals Processing, which counts Airbus, Boeing, Gulfstream, Lockheed, Northrop and several other commercial and military airframe manufacturers among its customers.

“I had always had this crazy idea about getting involved in metal finishing,” he says.

All Metals was founded in 1961, and now has almost 150 employees in its 65,000-square-foot facility in Stanton, California, counting anodizing, plating, painting, non-destructive testing and liquid coating application among its offerings.

After just over one year of experience in finishing, Coburn and his management team set their sights on another operation, nearby Embee Processing and its sprawling 124,000-square-foot, 10-building campus in Santa Ana, California.

“Embee was the crazy idea we had immediately following the AMP acquisition, but it wasn’t available at the time,” says Coburn, who is now CEO of both operations. “We were very pleased to acquire All Metals, but when Embee finally did become available, we knew we needed to obtain that operation, too.”

Two Top Shops

Two plants are better than one, Coburn surmised. Or in this case, two top-notch facilities are even greater. Both shops made the Products Finishing Top Shop Benchmarking Survey list for elite finishing operations in 2018, a rare feat for a single ownership group.

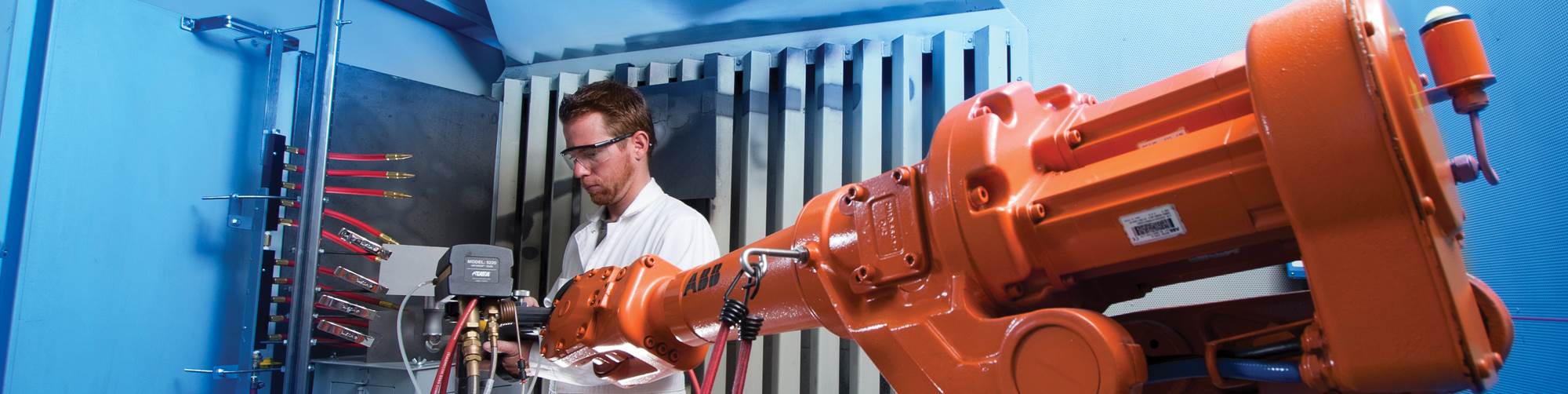

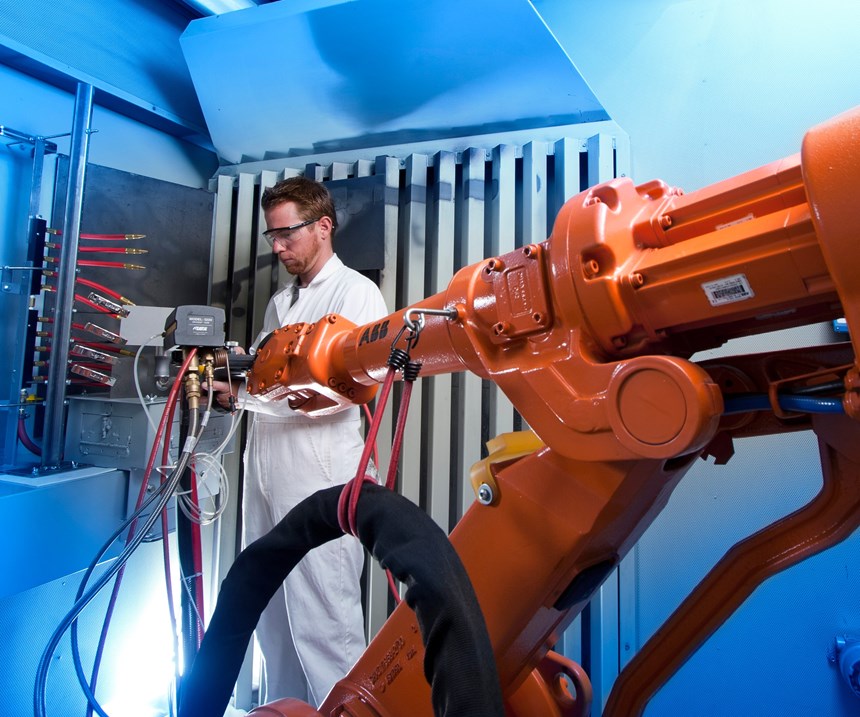

Embee specializes in aerospace finishes and provides a wide offering of non-destructive testing and specialty coating services. Coburn says the facility offers more than 70 metal finishing, inspection and testing processes that include chrome, nickel and cadmium, high-velocity oxy-fuel (HVOF), ion vapor deposition for cadmium, anodize/hard anodize, and paint and grinding services. Before Coburn’s group acquired it, Embee was part of the Triumph Group, headquartered in Berwyn, Pennsylvania, that designs, engineers, manufactures, repairs and overhauls a wide range of aircraft structures, components, accessories, subassemblies and systems.

Dan Crowley, Triumph Group’s president and CEO, says the Embee facility generated $42 million in sales in 2017, and the sale was part of the company’s transformation plan of divesting non-core businesses to reduce debt and to reinvest in new areas.

“Embee is an excellent fit with All Metals,” Crowley says. “We are confident that the synergies between the two companies will benefit them both in the long run.”

Coburn says adding the Embee operation together with the All Metals facility gives both companies a huge boost.

“It adds significant improvements and value to the supply chain,” he says.

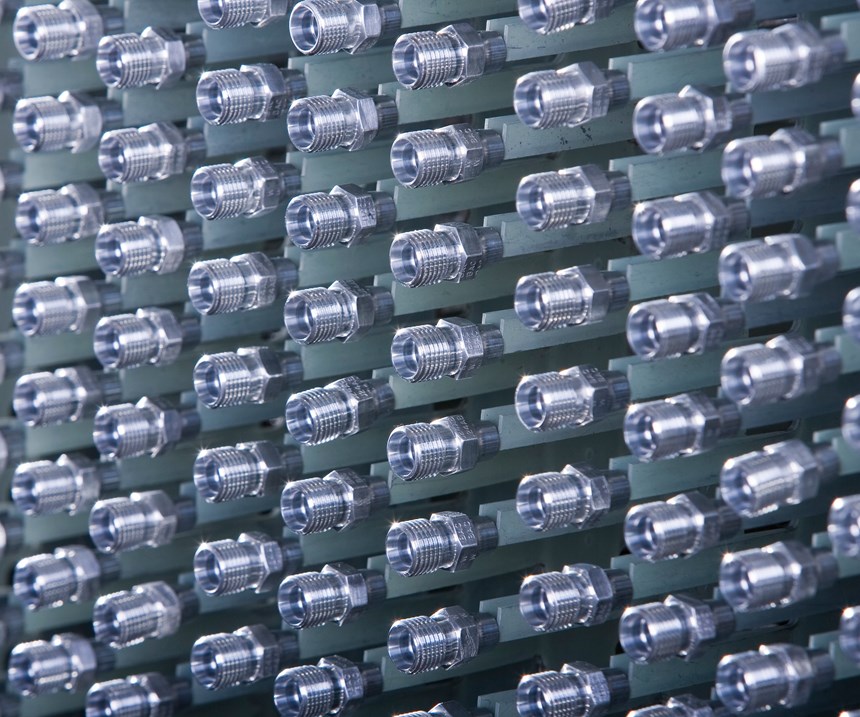

Extensive Finishing Services

All Metals Processing performs 56 finishing processes. Anodizing is run in a 12,000-square-foot building with 41 tanks that measure at least 12 feet in width. Plating operations are performed in a similar 12,000-square-foot area with 75 tanks and four ovens. Liquid coating is done in a similar-sized space with three paint booths, three ovens that cure to high temperatures and an additional packaging area. That department can spray all types of paint from fuel tank coatings and dry film lubricants, in addition to powder coatings. The shop also recently added nylon powder coating as a protective layer on parts that have significant movement or deflection. Non-destructive testing is performed in a 4,500-square-foot facility with three penetrant lines and a magnetic particle inspection line. All Metals’ logistics management unit has four trucks making daily deliveries and pickups.

Embee was started in 1948 as a two-person operation mostly focused on low-volume hard-chrome plating projects. It has now grown to a massive 10-building complex that is buzzing with activity and the constant movement of parts. Its most recent additions were a zinc-nickel line in late 2017 and boric-sulfuric anodizing line as a chrome-free replacement.

Coburn has spent the past year working between the two shops but says he spends a majority of his time at Embee getting to know all the customers and operations. Luckily, he has an experienced team at All Metals that includes John Crowell, general manager, who has 30 years of finishing experience, including as general manager at Hixson Metal Finishing and Prime Plating; and Matthew Moore, director of sales and marketing, who has more than 10 years’ experience in aerospace manufacturing and who worked alongside Coburn for several years. The Embee site has Jeff Conrad as general manager and Brian Nguyen as business development manager.

Negotiating a Purchase

Despite just being in his late 40s, Coburn has more than 25 years’ experience in aerospace manufacturing operations and executive leadership in both public and private sectors. Before entering the metal finishing industry, he was president of Cadence Aerospace, a $300 million private-equity-owned aerospace structure and equipment manufacturer that also made components, subassemblies and assemblies, and provided repair and overhaul services for some of the top makers of aircraft, aerostructures, aeroequipment and other defense platforms.

Coburn had been recruited by Cadence’s CEO to be the chief operating officer and to introduce operations capabilities and business systems for creating greater cohesion and focus on the company’s strategy and direction. He spearheaded the successful turnaround of two companies acquired by Cadence, including installing new teams and fixing financial and inventory issues. Prior to Cadence, he was vice president at Permaswage, $150 million private-equity-owned aerospace fluid fittings manufacturer with facilities in Los Angeles, France and China. The Pepperdine University graduate joined that company after spending three years at Precision Castparts’ fastener division, where he generated a 75 percent increase in gross profits through lean projects, manufacturing process changes, market share gains and pricing adjustments.

Coburn’s path to the finishing industry began when he met Derek Watson in early 2015. Watson is the son of the late Noel Watson, who spent much of his career as the CEO of Jacobs Engineering, one of the largest engineering services firms in the world. After Noel had retired several years ago, he and Derek formed Watson Family Investments, which is the investment group that ended up purchasing All Metals and Embee.

“I had been in aerospace and metal products my whole career,” Coburn says. “At Cadence, we did a lot of work with metal finishers, and we saw a lot of consolidation going on and capacity shrinking, and at one point we tried to buy All Metals then.”

That deal didn’t work out, but Coburn kept his eyes open for other opportunities that he felt might work.

“I am a products guy,” he says. “and I’ve always felt you needed run a finishing operation like a products business, where you are constantly having to be on time and you have these high expectations of the Boeings of the world. It really intrigued me.”

Purchasing Triumph

He started working with the Watsons in early 2015 and negotiated with the previous All Metals owners for about nine months before getting the deal finalized. Shortly after he became president of All Metals, he started setting his sights on Embee.

“I just got this crazy idea of going after Embee, too,” he says. “I always looked at them as the preeminent source of metal finishing, and if you asked anyone who was making an aerospace product, they would tell you the same thing.”

What impressed Coburn the most was the breadth of services that Embee offered, and that is what made it one of the “top one or two shops in the industry,” he says.

“Embee was doing just so many things, and it was very exciting to see that,” he says. “At All Metals, we didn’t do hard chrome or HVOF or IVD. But Embee was doing all of these very sophisticated coatings, plus they held these massive amounts of approvals.”

Triumph originally said no to selling, but Coburn again persisted. Several months later, he inquired again, and Triumph had warmed to the idea based on the fact that finishing was not part of its core. It took almost another year of negotiations, but in September 2017, the deal was finalized.

All Metals and Embee operate independent of each other, but both facilities are taking advantage of the synergies the two entities bring as one.

“Embee is certainly more well-known, but we see this as an opportunity to bring All Metals more to the forefront of what they do well, too,” Coburn says. “I think overall, it is working very well, and we are getting some great feedback from some of the primes.”

This past year, both shops attained Products Finishing Top Shops Benchmarking Survey status by finishing in the top 20th percentile of all shops—something that is difficult for one operation to achieve, let alone two that are just 16 miles apart.

“The fact is that the products that come out of both shops are very good,” Coburn says.

For information, visit allmetalsprocessing.com and embee.com.

Related Content

Possibilities From Electroplating 3D Printed Plastic Parts

Adding layers of nickel or copper to 3D printed polymer can impart desired properties such as electrical conductivity, EMI shielding, abrasion resistance and improved strength — approaching and even exceeding 3D printed metal, according to RePliForm.

Read MoreLiquid Chrome Vs. Chromic Acid Flake

Contemplating how to continue offering chromic acid services in an increasingly stringent regulatory world? Liquid chrome products may be the solution you’re looking for.

Read MoreSuccessful South African Plater Beating the Odds

Remaining focused on quality and reliability, Team Plating Works stays profitable in a volatile and challenging economy.

Read MoreAdvantages to Pumped Eductor Agitation

Not all agitation methods are created equally. Pumped agitation with eductor nozzles can improve process tanks and quickly show a reduction in operating costs while keeping staff safe, following environmental legislation and preventing pollution.

Read MoreRead Next

Episode 45: An Interview with Chandler Mancuso, MacDermid Envio Solutions

Chandler Mancuso, technical director with MacDermid Envio discusses updating your wastewater treatment system and implementing materials recycling solutions to increase efficiencies, control costs and reduce environmental impact.

Read MoreDelivering Increased Benefits to Greenhouse Films

Baystar's Borstar technology is helping customers deliver better, more reliable production methods to greenhouse agriculture.

Read MoreEducation Bringing Cleaning to Machining

Debuting new speakers and cleaning technology content during this half-day workshop co-located with IMTS 2024.

Read More

.jpg;maxWidth=300;quality=90)