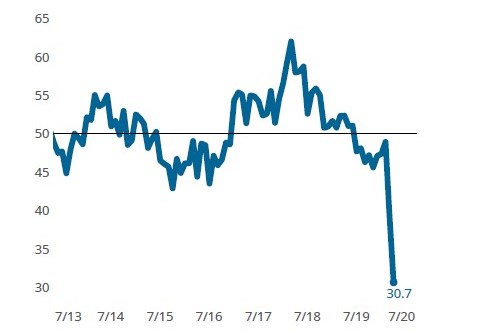

Finishing Index Contraction Accelerates As COVID-19 Disruption Continues

Index moves nearly 10-Points below prior low of 2012.

As the economic shutdown in response to COVID-19 continued for a second month, the Finishing Index reported its greatest contraction in history, ending April at 30.7. For comparison, the latest reading is over 9 points below the last historical low set in late 2012. Gardner would remind its audience that readings represent the breadth of change occurring within the industry and are not to be confused with the rate of change. The extremely low readings indicate only that a large proportion of finishers are reporting a decreased level of business activity.

Among the Finishing Index’s components, New Orders and Production are considered bellwether indicators of the remaining components of the business index. In the two-month period ending April 2020, both new orders and production had fallen by more than 30 points to end at half the level they stood at during their former all-time lows. These unprecedented drops in activity suggests that other measures of finishing activity have further to fall in the coming months.

In contrast to our other measures of business activity, the reading for supplier deliveries remains elevated. As stated in our March report, the reason for this has to do with how the supplier delivery question is asked with the component increasing when deliveries slow. COVID-19’s severe impact on supply chains has caused significant disruption, lengthening delivery time and thereby elevating the reading for supplier deliveries.

The Finishing Index is unique in its ability to measure business conditions specific to the finishing industry on a monthly basis. The challenges facing finishers today require leaders to have good data in order to make effective, forward-looking decisions. It is thus particularly important at this time for our readers to complete the Index survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the finishing industry along with the industry’s eventual recovery.

Finishing Index:

Business activity contracted at an accelerating rate in April. The latest reading puts the index nearly 10 points below its previously cyclical all-time low set in 2012.

New Orders and Production Fall to Unprecedented Lows

New orders and production frequently serve as bellwethers for other components of the Finishing Index. Both measures registered sub-20 readings in April, placing them more than 16-points below their prior all-time lows.

Related Content

-

Columbia Chemical and Alufinish Announce Collaboration

By combining their sales and service capabilities and resources for the U.S. market, the two companies will cover the entire aluminum alloy surface treatment process from pre-treatment to anodizing and coating.

-

HeaterTek Expands Capabilities for Metal Finishing Market

The electric immersion heater provider has acquired Industrial Heating Systems, a prominent player in the metal finishing sector.

-

Justifying Investments in Automation and Smart Solutions

Corey Sorrento of Carlisle Fluid Technologies discusses the long-term benefits and payoffs for investing in AI-driven technologies for your paint line.

.jpg;width=70;height=70;mode=crop)