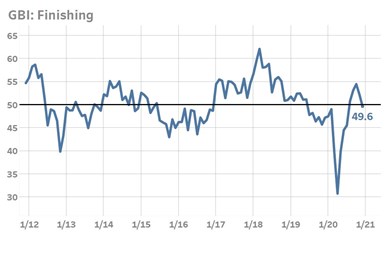

Finishing Index Ends Year Lower As New Orders Contract

GBI: Finishing reports a slight overall contraction in the finishing industry for December 2020 – largely due to a drop in new orders in the automotive and aerospace markets.

The Gardner Business Index (GBI): Finishing closed at its lowest point since August, ending December at 49.6. New orders, production and employment activity, which had expanded in recent months, all fell below a reading of 50 in the final month of 2020. When readings cross below 50, it marks a transition from expanding to contracting activity. In particular, new orders activity fell by more than 10 points for the month, causing it to drastically shift from being a leading driver of the Index’s recovery in recent months to becoming its greatest encumbrance. New orders activity fell most sharply in the automotive and aerospace markets. By company size, only large firms in excess of 250 employees reported a transition from expanding to contracting new orders activity.

Photo Credit: Gardner Business Intelligence

As Gardner predicted in our prior GBI release, supplier deliveries slowed due to the seasonal surge in holiday package delivery, and COVID-19 vaccine distribution efforts made the issue more difficult. As long as finishing input goods continue to compete for limited space on logistics carriers’ networks it is reasonable to expect that finishers will face further production constraints and rising material prices. In short, managing supply chains in 2021 will be an essential goal for all finishers.

The Finishing Index is unique in its ability to measure business conditions specific to the finishing industry on a monthly basis. The challenges facing finishers today require leaders to have good data in order to make effective, forward-looking decisions. It is thus particularly important at this time for our readers to complete the Index survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the finishing industry, along with the industry’s eventual recovery.

Related Content

-

Pulling Out All the Stops

Evolving coatings and finishes for automotive brake components.

-

Top Shop’s Journey to Building a Unique Brand

Since this new Ohio plater took over the space and assets of a former plating business, it is intentional about setting itself apart from prior ownership.

-

The New Wild West of Automotive Finishing

The advent of the EV and new application opportunities for finishers.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)