Business Activity Growth Slows During November

Lackluster New Orders and Supplier Delivery Activity Challenges Stymie Finishers

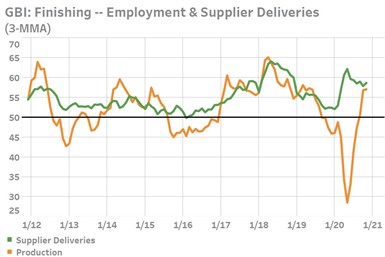

Finishing activity reported slowing growth in November after experiencing quickening expansion during the past three months.

Photo Credit: GBI

The Gardner Business Index (GBI): Finishing ended November at 52.2, falling just over 2 points during the month. Readings above 50 signal an expansion in total business activity compared to the prior month. Downward-trending readings above 50 signal a declining proportion of surveyed finishers reporting expanding business activity. A sizable slowing of new orders and production activity led November’s change, with a quickening contraction in export orders depressing orders activity. Despite this, the reading for employment activity expanded for the third time in the last four months.

Existing supply chain challenges will be made worse in the coming months due to seasonal shipping demand and vaccine distribution. Such constraints may have a detrimental effect on future production levels.

Photo Credit: GBI

The November reading for supplier deliveries rose to its highest level since July. As stated in previous reports, the reading for supplier deliveries rises when order-to-fulfillment periods lengthen. The combination of COVID-19 supply chain disruptions, the seasonal rise in fourth-quarter shipping demand and now the start of vaccine distributions across the globe will all further burden the world’s logistics infrastructure. The convergence of these events are almost certain to further slow delivery times. The consequence of even longer order-to-fulfillment times for finishers is likely to negatively impact future production levels.

The Finishing Index is unique in its ability to measure business conditions specific to the finishing industry on a monthly basis. The challenges facing finishers today require leaders to have good data in order to make effective forward-looking decisions. It is thus particularly important at this time for our readers to complete the Index survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the finishing industry along with the industry’s eventual recovery.

Related Content

-

Finishing Activity Ended March Down 1 Point vs. February

Finishing Activity: March saw the index revert to flat, closing at 50.3 compared to February’s 51.3.

-

Forms+Surfaces Expands from Humble Beginnings to Global Market Leader

Originally founded in Santa Barbara, California, the company now manufactures in multiple U.S. locations and in India.

-

Successful South African Plater Beating the Odds

Remaining focused on quality and reliability, Team Plating Works stays profitable in a volatile and challenging economy.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)