Is Aerospace Finishing Filled to Capacity?

As Boeing and Airbus demand more finishing capacity, the challenges faced by owners of finishing businesses are pressing, as both customers and regulatory agencies amp up demands for management attention and resources.

The surface finishing industry is experiencing a business environment unlike anything seen in the last 20 years. The strength of today’s operating environment has led to outstanding revenue and profitability growth, allowing finishers to fully recover from the recession.

In particular, the commercial aerospace industry—through expanding build-rates for new plane platforms such as the B737, B787 and others—has created a substantial amount of additional work for machining and finishing shops throughout the country, providing a direct benefit to providers of anodizing, plating and thermal spraying.

But the challenges faced by owners of processing businesses are pressing, as both customers and regulatory agencies amp up demands for management attention and resources.

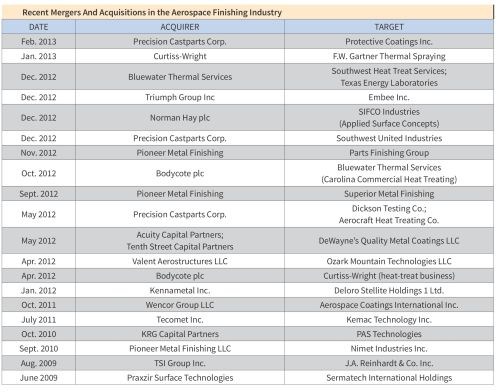

Supportive end-market dynamics, combined with a rapidly changing customer base and industry, have led to a dramatic increase in the number and valuation of mergers and acquisitions among private, family-held metal finishing companies.

Cyclical Industry

In 2013 alone, we’ve seen Precision Castparts purchase Protective Coatings, as well as the Curtiss-Wright takeover of F.W. Gartner Thermal Spraying. In 2012, it was Triumph Group buying out Embee, Norman Hay taking over SIFCO Industries, Precision Castparts purchasing Southwest United Industries and Pioneer Metal Finishing acquiring Parts Finishing Group and Superior Metal Finishing, among others.

Traditionally considered a cyclical industry, commercial aerospace is in the midst of what industry experts call a “super cycle.” The introduction of new, more fuel-efficient platforms such as the B787—as well as increased demand from emerging economies such as China—has both Airbus and Boeing pushing the global supply chain to support increased build-rates.

According to a study by Deloitte, Boeing and Airbus had combined production delivery of 1,189 aircraft in 2012, the highest production level achieved in large commercial aircraft history. The report said the commercial aircraft segment revenues increased 16.1 percent in 2012, while defense segment revenues decreased 1.3 percent.

Price Waterhouse Coopers estimates that the long-term forecast for commercial OEM aircraft is more than 30,000 deliveries in the next 20 years at a value of around $4 trillion.

PWC estimates that the 1,189 planes delivered by Boeing and Airbus in 2012, an 18 percent increase over the record year in 2011, will balloon to 1,700 annually—a 40 percent increase.

Strain on Suppliers

“The current and projected production levels will likely strain a supply chain that can be considered to have the most complex and longest lead time supply chain of any industry,” the PWC report for 2013 states.

As the original equipment manufacturers increase production, demand for additional product flows through the aero-structure supply chain, thus requiring a need for more available capacity at finishing shops.

First, the raw materials and forgings providers see spikes in demand, followed by growing need for machining services and finally flowing to the surface finishing industry to provide coating treatments for wear and heat resistance.

While the commercial aero-cycle has ramped up, the domestic supply chain has seen strong revenue and profitability growth as key platforms such as the B737 hit never-seen-before production rates. The chart below illustrates both historic and projected monthly build-rates for key commercial aerospace platforms.

Changing Status Quo

U.S.-based suppliers have historically concentrated on Boeing work packages because the supply chain for each OEM tended to be separated by the Atlantic. This is rapidly changing as Airbus continues to make a concerted effort to increase its U.S. production.

The rationale for Airbus to move production to the U.S. is multi-faceted, but at its center is the overloaded state of the European supply chain, as well as a desire to support economic development in the U.S. as a means to sell more aircraft to both the U.S. government and domestic carriers.

Airbus has gone so far as to break ground on a multi-billion-dollar A320 assembly plant in Mobile, Ala., that will employ thousands as well as provide indirect support to a range of supply-chain participants, including surface finishers.

As more Airbus work packages migrate to the U.S., the supply chain will benefit immensely. Aside from the associated revenue growth, new work will also allow domestic suppliers to diversify away from being dependent on Boeing for the first time since the company purchased McDonald Douglas in 1997.

Growth Opportunities

These supportive end-market dynamics are creating growth opportunities for the surface finishing supply chain, but have also placed stress on business owners. A result of increased build rates is pressure to maintain quick turnaround times, all while adhering to a strict set of quality-driven certifications and accreditations.

Every metal finishing business must navigate demanding Nadcap and customer-specific audits, all the while managing ever-tighter environmental regulations. Business owners are also managing customer concerns over rate-readiness and capacity constraints as they look at a metal processing supply chain that has had very few new entrants over the past several decades.

Surface finishing is also following the industry-wide trend of a desire by larger customers to deal with a smaller set of more sophisticated and capable suppliers. Customers are increasingly pressuring finishers to invest in new coating lines to support varying part envelopes, or to offer a wider range of process types, all as part of an effort to provide a “one-stop” solution.

This combination of headaches also serves as an important barrier to entry and competitive differentiator for those businesses that can thrive and grow in this challenging environment.

An additional factor for the industry is the increasing consolidation and transition out of family ownership for the machining and surface finishing industries. Over the past decade, owners of traditionally family-held businesses have reached retirement age and sold majority control to larger strategic buyers or private equity groups.

Strategic Shifts

With these changes, many of these shops have undergone strategic shifts in supplier management that have transitioned away from a relationship-based approach to a more calculated analysis based on a set of objective rationale.

While this approach has left smaller, less sophisticated surface finishers at a crossroads, it has benefitted those that have invested in new equipment, ERP and quality systems. This rampant consolidation is poised to continue as a supportive lending environment has driven valuations to levels not seen since 2007.

All of these dynamics have combined to create an interesting environment for mergers and acquisitions in the metal finishing industry.

In general, the M&A market has nearly fully recovered from the 2008-2009 period, as both the number of—and valuations for—transactions have improved markedly. For the metal processing industry specifically, activity over the past year has increased as large, publically traded machine shops such as Precision Castparts and Triumph Group have sought to vertically integrate by acquiring some of the larger family-owned metal processors and finishers, including Southwest United, Embee and Procoat.

While rationale for these acquisitions varies, a uniting theme is the emergence of surface finishing as a key strategic component of the aerospace and defense supply chain. As large companies face pressure from customers on turnaround times and quality, they have also sought to bring surface finishing capabilities in house to capture margin and reduce lead times.

In-Sourcing Trend

Though the in-sourcing trend is cyclical, it has created opportunities for the remaining independent suppliers, as their customer base is—with good reason—hesitant to send parts to fully integrated vendors.

This recent M&A activity around some of the larger metal processing businesses has many finishing shop owners considering their ultimate end-goal, or liquidity event for their businesses. As strategic buyers have completed these purchases at seller-friendly valuations, the surface finishing industry has become a focus of the private equity community as well.

The private equity industry has traditionally been highly active in the machining industry. However, there is now a growing awareness that the surface finishing industry may offer a more attractive investment opportunity, given that it has same beneficial macro-economic backdrop with lower capital expenditure requirements.

This growing interest has led to significant improvement in assessments. Sellers of finishing businesses are seeing valuations at or near historic highs in terms of valuation to cash-flow ratios.

Challenges Ahead

This process is not without its challenges, as potential investors must navigate the environmental issues associated with legacy processes, as well as the fact that the industry traditionally has operated without the long-term contracts prevalent in the machining world.

But, there is an unprecedented demand for surface finishing businesses that is likely to continue through the remainder of 2013 and into next year. We expect activity in the finishing industry to continue to increase as business owners capitalize on this unique time.

Ryan Murphy is vice president of Salem Partners, a Los Angeles-based investment bank and wealth management firm. He is a member of their Aerospace and Defense Group. He can be reached at rmurphy@salempartners.com

Related Content

Anodizing for Bonding Applications in Aerospace

Anodizing for pre-prep bonding bridges the gap between metallic and composite worlds, as it provides a superior surface in many applications on aluminum components for bonding to these composites.

Read MoreUnderstanding PEO Coatings

Using high-speed cameras and back side illumination (BSI) sensor technology to analyze plasma electrolytic oxidation.

Read MoreFinishing Systems Provider Celebrates 150 Years, Looks to Future

From humble beginnings as an Indiana-based tin shop, Koch Finishing Systems has evolved into one of the most trusted finishing equipment providers in the industry.

Read MoreProducts Finishing Reveals 2024 Qualifying Top Shops

PF reveals the qualifying shops in its annual Top Shops Benchmarking Survey — a program designed to offer shops insights into their overall performance in the industry.

Read MoreRead Next

Aerospace Drives More Calls for Non-Chrome Passivate Finishes

More finishers are warming up to using non-chrome passivation as a way to satisfy customers who don’t want to use hexavalent chromium for corrosion treatment.

Read MoreA ‘Clean’ Agenda Offers Unique Presentations in Chicago

The 2024 Parts Cleaning Conference, co-located with the International Manufacturing Technology Show, includes presentations by several speakers who are new to the conference and topics that have not been covered in past editions of this event.

Read MoreEpisode 45: An Interview with Chandler Mancuso, MacDermid Envio Solutions

Chandler Mancuso, technical director with MacDermid Envio discusses updating your wastewater treatment system and implementing materials recycling solutions to increase efficiencies, control costs and reduce environmental impact.

Read More