Index Contracts on Weak Backlogs and Exports

October Finishing Index: 47.3

The Finishing Index cited a fourth consecutive month of contracting business activity, registering an October reading of 47.3. Index readings above 50 indicate expanding activity while values below 50 indicate contracting activity. The further away a reading is from 50 the greater the magnitude of change. Data in recent months have been bifurcated with production, new orders and supplier deliveries oscillating around the 50 mark while simultaneously backlog and export readings have trended toward accelerating contraction. Gardner Intelligence’s review of the October data found that the Index was supported by expanding new orders, supplier deliveries and production. The Index (calculated as an average of its components) was pulled lower by a mild contraction in employment activity and steeper contractions in backlog and exports activity.

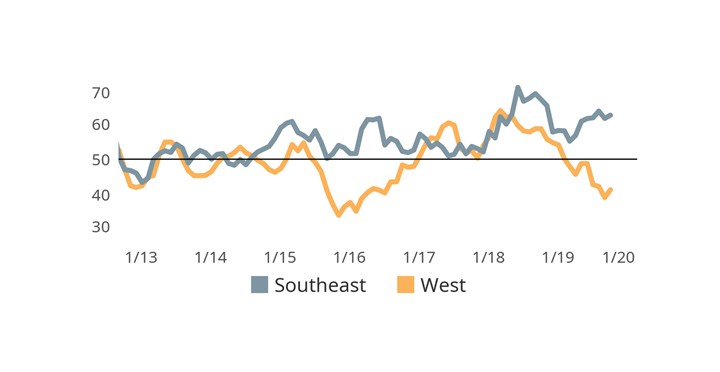

The combination of expanding total new orders, coupled with contracting export orders, implies that domestic orders expanded strongly in October. A similar event was experienced in September when total new orders registered no change while export orders contracted. Gardner’s survey data in 2019 has indicated that a finisher’s geographic position has had a strong influence on new orders activity. According to the data, finishing new orders have and continue to expand in the southeast U.S., while finishers in western U.S. states have experienced steeply contracting order activity.

The Finishing Index contracted further during October, slowed by contracting activity in backlogs and exports.

Finishers located in the Southeast U.S. have reported significantly better new orders activity in 2019 than their U.S. based peers located elsewhere. West-based finishers have experienced the greatest contraction in new orders activity.

Related Content

-

10 Anodizing Best Practices

Following this list of guidelines can help to increase the performance, cost effectiveness and quality for your anodizing operation.

-

Understanding and Managing White Spots on Anodized Aluminum

Having trouble with spotting defects when anodizing? Taj Patel of Techevon LLC offers a helpful overview of the various causes of white spots and potential solutions.

-

Products Finishing Reveals 2024 Qualifying Top Shops

PF reveals the qualifying shops in its annual Top Shops Benchmarking Survey — a program designed to offer shops insights into their overall performance in the industry.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)