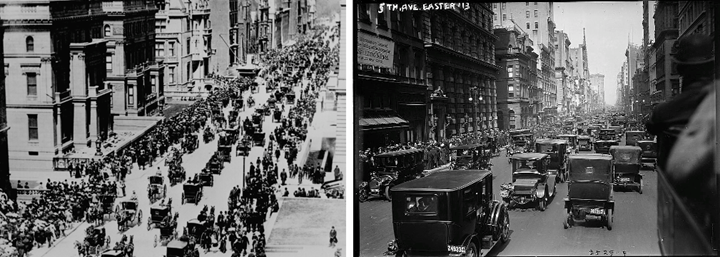

Left: Easter morning 1900, 5th Avenue, New York City. Spot the automobile. (Source: U.S. National Archives). Right: Easter morning 1913, 5th Avenue, New York City. Spot the horse. (Source: George Grantham Bain Collection).

Q: We keep hearing about the changeover to electric vehicles and, as an applicator, we are looking for expansion opportunities but wonder about the reality of electric vehicles and what we can expect in terms of changes or automotive demand for future finishes?

A: Valid questions. As recently as five years ago, there continued to be doubt about the viability and growth of the electric vehicle (EV) market. Many people said it wasn’t realistic, it’s too far off, the supporting infrastructure is nonexistent, the focus is not there, etc., but now, that is all changing. You can see it in everything from advertisements to automotive initiatives and investments — the roadmap to EVs is firmly in place. And it will happen faster than we think.

One of the most relevant examples of this type of disruptive technology happened in the early 1900s (see photo example). On a bright Easter morning in 1900, you could only spot one lone automobile amongst 50 horse-drawn vehicles on a busy New York Street. Just 13 short years later, on the same street, in the same town, there was only one single horse-drawn vehicle to be found amongst all the automobiles. Disruptive change had happened.

And it will happen again with EVs. It will not happen as a limited or small segment commitment either. Recent studies have shown OEMs are launching EVs into the high-profit margin segments of their SUVs, crossover vehicles and pickup trucks. There are a total of 87 new EV launches planned for North America between now and 2028. And 1.2% of these launches are coming from brand new EV startups (Rivian, Lucid and Amazon/Zoox, etc.) who are joining the existing field of OEMs committed to this evolution in automotive technology.

To address your question about the impact on the finishes and coatings needed, we should first review the radical shift in supplier components to the powertrain between internal combustion engines (ICE) and EVs. The basic components of an ICE powertrain include the internal combustion engine, transmission, turbocharger, fuel system, exhaust system and air intake system. On an EV, the basic components include a battery pack, an inverter, DC converter, traction motor, gearbox, and an onboard charging module. At the base level, these changes will require additional financial investments into the component manufacturing from the supply base.

From a surface finishing supply standpoint, there are often two concerns related to EVs: 1) Will steel consumption drop and 2) Will there be less fasteners on EVs? Let’s look first at steel consumption.

The initial concern is that EVs are lighter weight and use less steel, however, it is important to note the weight of the battery pack replaces the weight of the engine and transmission. Projections indicate that overall ICE vehicle volumes will drop as EV volumes begin to increase, and total steel usage will remain at a steady volume, even increasing some over the next 20 years.

It is true that automotive manufacturers are looking at alternatives for lighter weight materials such as aluminum, aluminum alloy, magnesium and carbon fiber. Joining these different substrates together will lead to new challenges in coatings, especially associated with fasteners. A fastener connected to a piece of steel with a coating has a different galvanic reaction than a fastener connected to a piece of aluminum or other possible substrates. These differences impact corrosion resistance, conductivity, and raise concerns with electrical components. Further work is being done to evaluate fastener coating conductivity and determine what deposits interact best when mated with various substrates.

To answer the question as to if there will be more or less fasteners on EVs, initial expectations on fastener usage indicate there are up to 20-25% more fasteners on the EV compared to an ICE vehicle. The battery packs in EVs need to be amply fastened to the battery mounts and then to the frame. Due to the need for enhanced corrosion protection and the previously mentioned conductivity concerns with galvanic reactions, the coatings preferred for fasteners will be alloyed coatings such as zinc nickel and tin zinc because both have less of a chance of whiskering, therefore reducing the chance of short outs or other issues with the electrical components.

There is currently strong interest from the automotive manufacturers in tin-zinc, zinc-nickel, and tin coatings. There will be more part number callouts, specifically related to fasteners and bus bars in automotive vehicles.

Another note on coating choice is related to the braking systems on EVs, which still use the traditional hydraulic braking system (disc and calipers); however, the demand of the braking system is not as strong in an EV as it is in an ICE vehicle. As a result, the brake shoes and brake pads that are currently changed every 3-5 years in an ICE vehicle will need to last 10 years or more in an EV, requiring higher quality finishes such as zinc nickel in place of the current zinc and zinc-phos coatings that are currently used.

Overall, the zinc-nickel market has expanded more than 4x in the last five years, due in part to the lengthening of automotive warranties and demand for enhanced corrosion protection. Alkaline zinc nickel currently represents the majority of the market, approximately 85%. However, acid zinc-nickel is quickly growing in popularity due to its superior activation capabilities and the ability to plate larger quantities of parts quickly and efficiently, particularly those with difficult substrates, such as brake castings and fasteners.

As a recap, the roadmap is in place and the electrification of vehicles is here to stay. The necessary substrate changes, conductivity concerns and demand for enhanced corrosion protection inherent in EVs will provide growth opportunities for applicators in areas such as tin-zinc, zinc-nickel and tin to meet the evolving needs of automakers.

About the Author

Photo Credit: Columbia Chemical

Mark Schario

Mark Schario serves as Executive Vice President for Columbia Chemical. Visit columbiachemical.com.

Related Content

How to Maximize Nickel Plating Performance

The advantages of boric acid-free nickel plating include allowing manufacturers who utilize nickel plating to keep up the ever-changing regulatory policies and support sustainability efforts.

Read MorePossibilities From Electroplating 3D Printed Plastic Parts

Adding layers of nickel or copper to 3D printed polymer can impart desired properties such as electrical conductivity, EMI shielding, abrasion resistance and improved strength — approaching and even exceeding 3D printed metal, according to RePliForm.

Read MoreNanotechnology Start-up Develops Gold Plating Replacement

Ag-Nano System LLC introduces a new method of electroplating based on golden silver nanoparticles aimed at replacing gold plating used in electrical circuits.

Read MoreTroubleshooting Alkaline Zinc

One of the most common problems that can arise when plating with alkaline zinc is an imbalance of brightener in the solution. In this helpful Ask the Expert article, Chad Murphy of Columbia Chemical discusses how different zinc metal concentrations and brightener concentrations can impact efficiency.

Read MoreRead Next

The EV and the Curing Oven

How will the advent of electric vehicles change paint curing processes and oven requirements?

Read MoreCoating for Mobility

Addressing the increasing demand for e-mobility and the market’s evolving coatings needs.

Read MoreCoatings Drive Electric Vehicles Further

Electric vehicle batteries depend on coatings to maintain optimal temperatures, reduce the risk of fire damage and electrical interference, and more.

Read More

.jpg;maxWidth=300;quality=90)