Fair Conditions Forecast for the Finishing Industry

As the American economy entered 2004 with less anxiety than 2003, many in the manufacturing industry couldn’t stop worrying about the dark cloud that has loomed over it. While the finishing segment has weathered an especially long and severe storm for the past few years, Products Finishing’s 2004 Capital Spending Survey results indicate that the future seems to be clearing…

In September 2003, Products Finishing magazine, mailed out 1,000 surveys to a cross-section of finishing plants, in order to gage their views and estimates on spending in 2004 on finishing-related equipment. The survey results reveal a relatively encouraging outlook for spending. The vast majority of companies have plans to either spend the same amount or to increase spending, while a very small percentage plans to cut spending on equipment. And while some types of finishing seem to hold more promise than others, the outlook seems to be looking brighter for all of the finishing industry.

Although this is not the first capital spending survey for Gardner Publications, Inc. (parent company of Products Finishing magazine), it is the first survey conducted for the metal finishing industry. Gardner Publications, Inc. has conducted a metalworking capital spending survey for 36 years now and has developed a +/- 6% of accuracy over the life of the survey. The knowledge and experience gained through that survey served as the foundation that Products Finishing based its survey. We plan to keep this survey an annual tradition and hope to expand the number of plants surveyed. We anticipate that this survey will become the groundwork for businesses in the finishing industry to base marketing decisions and future investments on.

| Figure 1: Types of finishing processes each plant performs: | |

| Process | Percentage of plants that perform the process |

| Painting | 55.4% |

| Polishing/buffing/surface refinement | 45.2% |

| Pretreatment | 28.9% |

| Powder coating | 22.3% |

| Electroplating | 21.1% |

| Anodizing | 9.6% |

| Electrocoating | 4.8% |

| Other | 19.3% |

| (sum of percentages greater than 100 due to plants that perform multiple processes) | |

The survey received a 17.2% response from those surveyed. Although, this is a small percentage of the finishing industry, the results are compiled from their responses and are believed to be statistically reliable and a fair representation of the industry’s expected spending plans.

Finishing plants ranged in sizes from having less than 20 employees to as many as 2,500 employees. When asked at what level of capacity the plant was operating, the average of the responses was 73.7%. For reference, businesses seem to be in the purchasing mode when capacity is approaching or above 80%. Figure 1 breaks down the types of finishing processes that each plant performs.

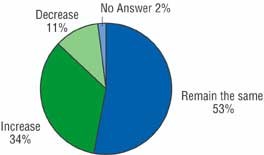

The survey results showed that despite facing multiple challenges, 34.3% of the respondents plan to increase spending on equipment, with more than 52% saying they plan to spend the same as the previous year. These respondents reveal a fairly promising, if not optimistic, move into 2004. It seems that businesses are beginning to feel a little more comfortable and less cautious when it comes to making equipment investments.

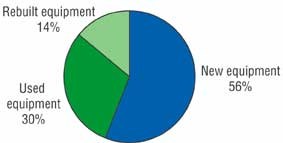

Based on the survey we estimate that plants will spend more than $2.26 billion on equipment, broken down into new equipment ($1.2 billion), used equipment ($678.4 million) and reconstructing/rebuilding equipment ($322.2 million) (see Figure 3). Survey respondents were asked to define specifically what type of finishing equipment they were looking at purchasing. Auxiliary equipment had the best response, followed by plating/anodizing equipment, powder coating equipment, then painting equipment (Figure 4).

Plants predicted spending more than $1.1 billion on new, used and refurbished auxiliary equipment. We broke down auxiliary equipment into subcategories including pretreatment (23.4%), ovens (22.8%), polishing/buffing (22.3%), conveyors (7.8%), cleaning/stripping (5.0%) and other auxiliary equipment (18.7%).

Investments in powder coating equipment were estimated at being more than $405.6 million and were broken down into systems (42.0%), booths (15.3%), powder guns (6.7%) and other powder equipment (31.8%). Paint equipment was divided into four subcategories: painting guns (39.5%), painting systems (32.0%), painting booths (15.3%) and other painting equipment (13.2%), with paint equipment investments estimated at being $218.1 million.

Plating and anodizing equipment was broken down into several subcategories, with pumps (37.4%) having the largest percentage spent followed by pollution control equipment (19.3%), then heaters/heat exchangers (10%). All of the other subcategories received less than 10% of the total $515.2 million expected to be spent on plating equipment.

What can one assess from all of these numbers? Well, one thing is for certain, the future is looking fair, if not good, and appears to be on the road to better, brighter days. Time can only tell if the economic storm the finishing industry has endured is completely clearing, but the responses from this survey seem to point to yes.

Related Content

HeaterTek Expands Capabilities for Metal Finishing Market

The electric immersion heater provider has acquired Industrial Heating Systems, a prominent player in the metal finishing sector.

Read MoreTop Shop Pivots With Industry Demands

Moving from cars and motorcycles to its current aerospace and architecture customer base, this California powder coatings shop has evolved and grown with the changing market.

Read MoreColumbia Chemical and Alufinish Announce Collaboration

By combining their sales and service capabilities and resources for the U.S. market, the two companies will cover the entire aluminum alloy surface treatment process from pre-treatment to anodizing and coating.

Read MoreHenry Ford Is Still Right When It Comes to Color

Who would have imagined that more than 100 years after his famous statement about any color as long as it’s black would still have relevance of a sort?

Read MoreRead Next

A ‘Clean’ Agenda Offers Unique Presentations in Chicago

The 2024 Parts Cleaning Conference, co-located with the International Manufacturing Technology Show, includes presentations by several speakers who are new to the conference and topics that have not been covered in past editions of this event.

Read MoreEpisode 45: An Interview with Chandler Mancuso, MacDermid Envio Solutions

Chandler Mancuso, technical director with MacDermid Envio discusses updating your wastewater treatment system and implementing materials recycling solutions to increase efficiencies, control costs and reduce environmental impact.

Read MoreEducation Bringing Cleaning to Machining

Debuting new speakers and cleaning technology content during this half-day workshop co-located with IMTS 2024.

Read More