April Finishing Business Index at 53.4

Reading reflects the fourth consecutive month of growth.

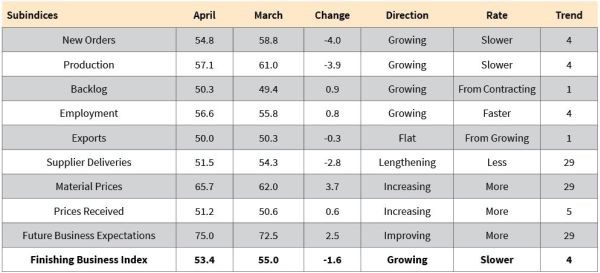

With a reading of 53.4, the Finishing Business Index showed that the finishing industry grew in April for the fourth consecutive month. Since August, the level of business activity in the industry has been improving steadily. The April index was 5.7 percent higher than it was one year earlier, and this was the eighth consecutive month that the month-over-month rate of change grew. Annually, the industry grew at an accelerating rate in both March and April.

New orders and production increased at a significantly accelerating rate the first four months of this year, and both have been improving steadily since August. Backlogs increased for the first time since May 2012, an increase of 11 percent over April 2013. The annual rate of change has accelerated each of the previous three months. This indicates higher capacity utilization levels and capital spending in the industry in 2014. Employment has grown for four straight months, and hiring is increasing at its fastest rate since March 2012. However, exports remained flat in April after increasing in March. Supplier deliveries continue to lengthen, but they are lengthening at the second-slowest rate since the index began.

Material prices increased in April at their second-fastest rate since February 2013. While material prices have been increasing at a generally faster rate this year, prices received have been increasing at a modest and constant rate. Future business expectations remain strong and near their highest levels since March 2012.

One of the main reasons for the slightly slower growth in April was that facilities with more than 100 employees saw a slower rate of growth, and facilities with 50-99 employees contracted after growing at a very significant rate the previous three months. Counteracting the weak conditions at the larger facilities was the improved business conditions at smaller finishers, however. Finishers with 20-49 employees expanded for the fourth month in a row and grew at their fastest rate since May 2012. Finishers with fewer than 20 employees continued to contract, but they did so at their slowest rate since August 2012.

Future capital plans were at their second highest level since October 2012, and the month-over-month rate of change increased at more than 30 percent for the second month in a row. The annual rate of change contracted at its slowest rate since at least November 2013.

To see the historical breakdown of our business index and each of its subindices, visit gardnerweb.com/forecast/finishing.htm.

Related Content

-

Sparktek Acquires Marca Coating Technologies

Two of North America's vacuum metallizing companies are coming together to provide domestic, high-volume vacuum metallizing services to multiple industries.

-

EPSI Acquires Custom Rack

EPSI is continuing to grow with the acquisition of Custom Rack, based in Euless, Texas.

-

Understanding and Managing White Spots on Anodized Aluminum

Having trouble with spotting defects when anodizing? Taj Patel of Techevon LLC offers a helpful overview of the various causes of white spots and potential solutions.

.JPG;width=70;height=70;mode=crop)